While mobile payments have been off to a slow start in most of the Western world—even the rollout of EMV chip payments in the United States is far behind schedule—China has become the melting pot for mobile payment solutions.

The mobile payment space has become fiercely competitive, with both market leader Alibaba and messaging giant WeChat scrambling for valuable market share. However, what was once a strictly domestic affair has expanded abroad, with China’s mobile payment providers now battling for Chinese tourists’ mobile payments on the global stage.

For overseas destinations, hotels, retailers, restaurants, and tourist attractions, this makes the Chinese payment landscape a lot more complicated than it used to be. Until recently, accepting payments through the Chinese government-backed UnionPay interbank network used to be the gold standard for payments made by Chinese tourists. Indeed, updating the points of sale terminal (POS) to accept UnionPay and slapping a UnionPay sticker on the front door was all that was needed to reach the forefront of Chinese payment implementation.

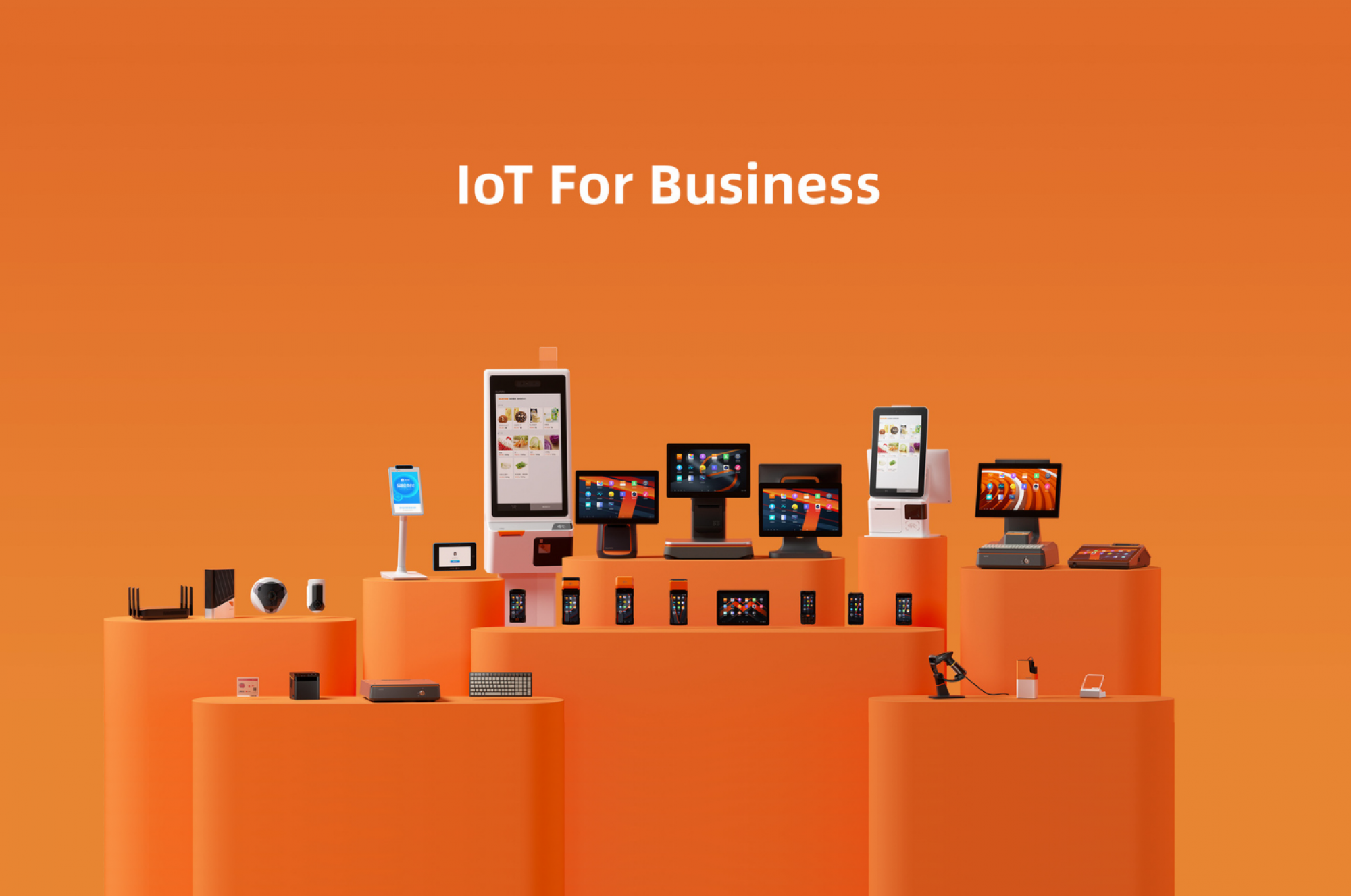

Which hardware to support Chinese mobile payments global expansion ?

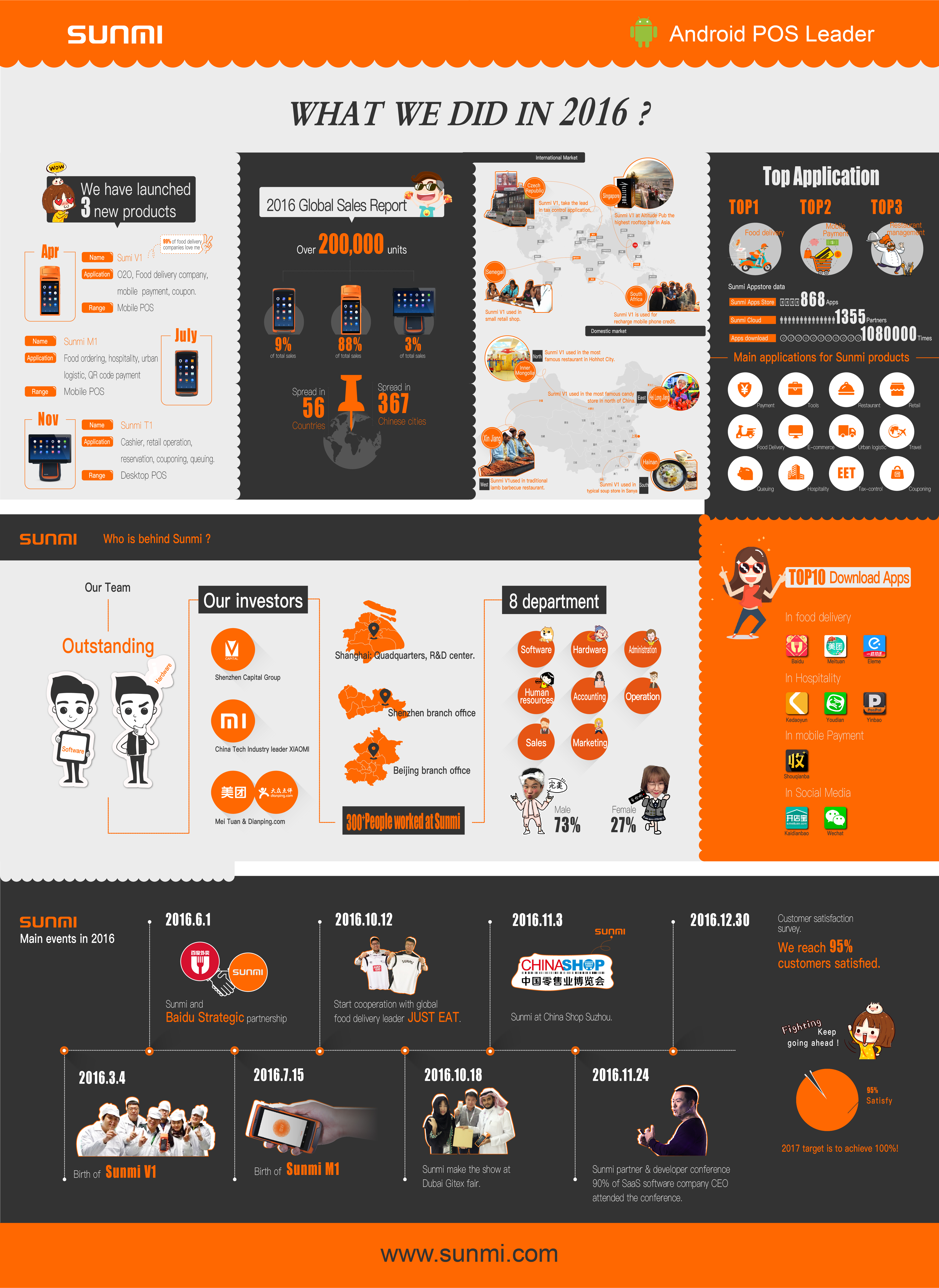

The good news is that, given the fierce competition between WeChat Pay (Tencent) and Alipay (Ant Financial Alibaba Group ), Chinese mobile payment providers are now doing their best to rapidly expand overseas by implementing a wide range of local partnerships. As partner of Wechat Pay and Alipay, Sunmi plays a key role in the business expansion.

First Data (NYSE: FDC), a global leader in commerce-enabling technology, and Alipay, one of the world’s leading online payment platforms, today announced that North American businesses will be able to accept the mobile payment service and expand Alipay’s already significant business base. First Data will implement Alipay at the point-of-sale for its four million U.S. business clients.

Citcon, an integrated mobile payment and marketing platform to connect global merchants with Chinese travelers, announces partnership with WeChat, China’s leading mobile social communications service with 846 million active users run by Tencent Holdings. As the first payment partner of WeChat in North America, Citcon will enable millions of businesses to accept WeChat Pay, one of China’s most popular mobile payment methods.

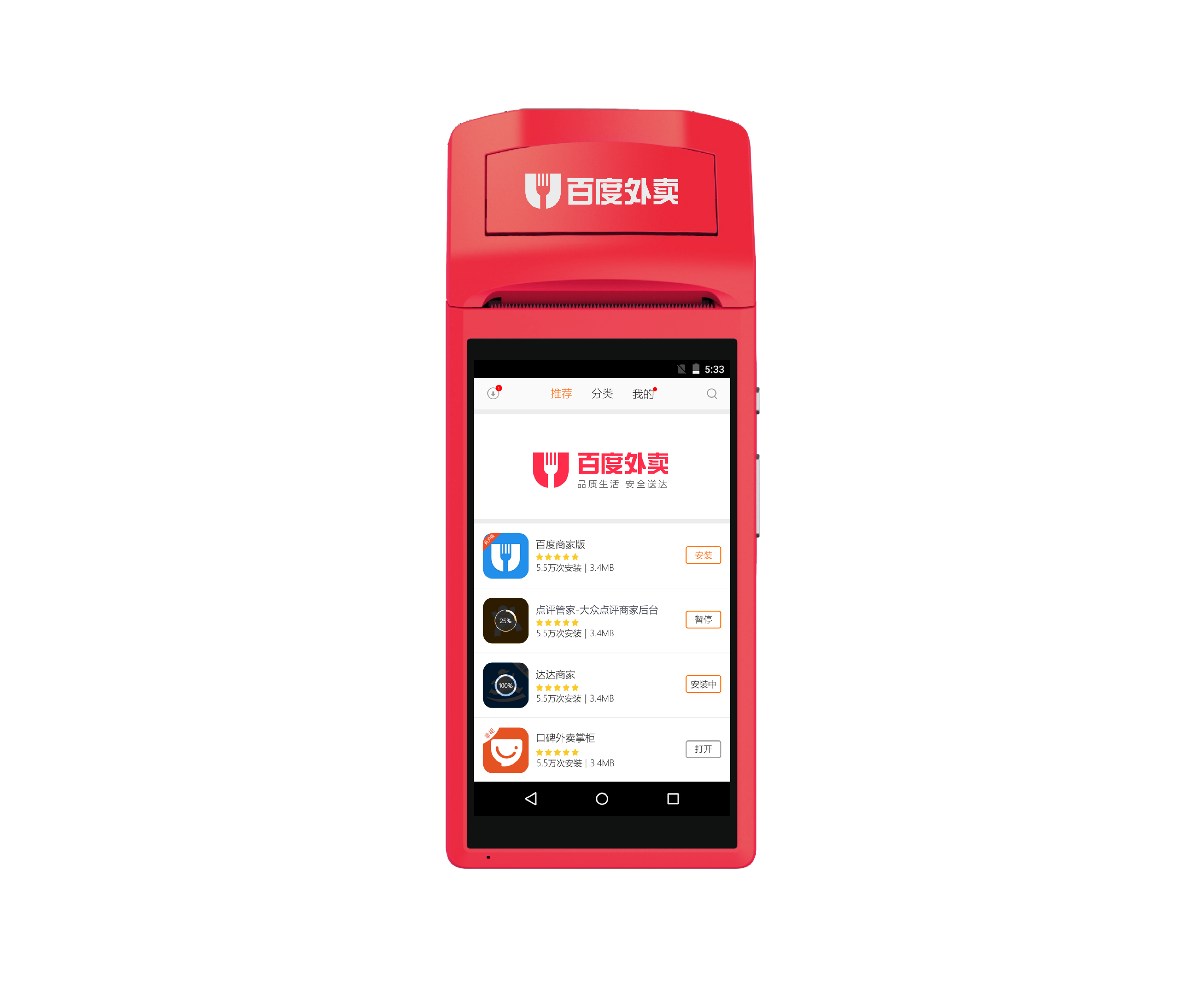

Now merchants will be able to accept WeChat Pay via Citcon’s smart mobile point-of-sale (Sunmi V1), easy-to-integrate API and software products and optimize growth both online and offline, with an easy and affordable rate compared to credit card processing.

Source:

Technode

FirstData

Citcon

Alizila

After 11 month, it have been proved to be a right decision. There are 194 million Food Delivery customers in China now, and market in Q1, 2017 reach USD 12.9 billion.

After 11 month, it have been proved to be a right decision. There are 194 million Food Delivery customers in China now, and market in Q1, 2017 reach USD 12.9 billion.